Senator McCain Forgot Who Is In the White House

I have been seeing John McCain ads that say things like "economy in shambles," "soaring food and energy prices," and "you are worse off than you were four years ago." I haven't been able to understand these statements because the person currently in charge is George W. Bush who is pursuing the same economic policies that Senator McCain has endorsed in his campaign.

It doesn't make any sense to tell people how bad things are if you intend to pursue the same policies that brought on the disaster. I mean Ronald Reagan was able to effectively use the line, "are you better off now than you were four years ago?" precisely because he was running against the person who was in the White House. It wouldn't have made any sense for Jimmy Carter to ask "are you better off now than you were four years ago?"

Anyhow, it finally occurred to me that Senator McCain must have forgotten who was in the White House. After all, if he can't remember how many homes he owns it is easy to believe he can't keep track of who is running things. This isn't a question of age, it's about being confused. My grandfather lived to be 90 and he was never confused. With his last breath he could have told you who was in the White House and exactly how many homes he owned.

Maybe, we can get someone with the McCain campaign to clarify the situation for the Senator so he can stop running these silly ads.

Why McCain's Wealth Matters

For all the ink spilled over this last week, two related issues were under-explored, the latter of which is especially important: what's 'rich,' and why does it matter? What does McCain's wealth, and the way he talks about it, reveal about his ability to be a successful president?

On the first point--what means 'rich'?--there's no simple answer, no line in the economic sand that divides the rich from the rest. I'll get to the income data in a second, but they're only of marginal help here.

For one, there's tremendous geographical variation. If your family income is $100,000 in a rural area of a low-income state, you're well off. That income in Manhattan arguably puts you in the middle-class.

This example also suggests that there's a relative component to "rich." To be rich means you breath the rarified air in the upper reaches of the income scale. In a series of recent revealing remarks, McCain said he thought an income of $5 million made you rich. There's no doubt that's true, but if that's your income cutoff, almost nobody's rich.

The often-cited work of income analysts Piketty and Saez (see Table 0) reveals that admission to the top 1% of the income scale will run you a cool $375,000. Too many common folk there for your taste? Then you'll need about $600K to move up to the top half of the top 1% (i.e., the top 0.5%).

What's that? You want to roll with some serious money? It'll cost you $2 million to break into the top 0.1% (the top tenth of the top percent), and $10.5 million for the top 0.01% -- the top one-hundredth of the top one percent, average income: $30 million.

So yes, Cindy's $100 million in wealth, inherited from her family business, puts the McCain family solidly up there in the narrowest sliver of the richest of the rich. But numbers like these only give you an upper bound. Certainly, there are more rich people in America than those who reside in the 15,000 households of the top 0.01%.

My research on income class has led me to take a less quantitative approach to the question of who's middle class, rich, poor, etc. I think it has much to do with your choices and your access to opportunities.

Rich people's choices are generally not constrained by lack of income (boy, that sounds really obvious, but read on). Years ago when I worked with poor clients in New York City, I remember someone telling me they thought about cost before making a long-distance phone call.

Move up the "choices chain" and you get the picture. Middle class people tend not to think twice about a phone call, but a baby sitter, dinner, and a movie, is not a slam dunk right now, what with prices up and incomes down. And speaking of the price of transportation, vacations don't become "stay-cations" for rich people. Their choice set isn't constrained that way.

These choices may sound kind of trivial, but of course, there are real life-changing opportunities at stake here. One of my favorite -- well, least favorite, really -- factoids to make this point has to do with access to higher education. Once you control for cognitive ability, high-testing, low-income kids have the same (low) college completion rates as low-testing high-income kids. We do not, my fellow HuffPosters, reside in a meritocracy.

(If I may shamelessly tout my own work with colleagues at EPI, please read our forthcoming chapter on income mobility from the new State of Working America, out Labor Day -- though I'll see if I can get the mobility chapter posted here ASAP. It's a tour through this critical question of how challenging it is for people to get ahead given the mobility barriers they face these days. To us, this strikes at the heart of a basic American economic value. We may not believe in equal outcomes in this country, but we sure believe in equal opportunities. And the data on inequality and mobility suggest this basic value is under siege.)

Oh, and yes, if you don't know how many homes you own, you're definitely rich. (When I told my sister about this McCain gaffe last week, she responded: "Well, I don't know how many pairs of shoes I own." See...it's all relative.)

Which brings us to he who would be president. I understand and appreciate the urgency in campaigns to frame your opponent. In this case, the Obama team jumped quickly and effectively on these gaffes to paint McCain as elite and out-of-touch. But beyond the campaign politics, what do these statements, and more pointedly, his wealth, say about McCain as president?

After all, FDR was rich, and his empathy and energy devoted to helping the have-nots was boundless. Lots of politicians who came from humbler backgrounds but ended up rich, like Bill Clinton, John Edwards, or for that matter, Barack Obama, also built a policy agenda to offset the status quo regarding inequality and opportunity. Is it simply that rich Democrats get this in a way rich Republicans don't?

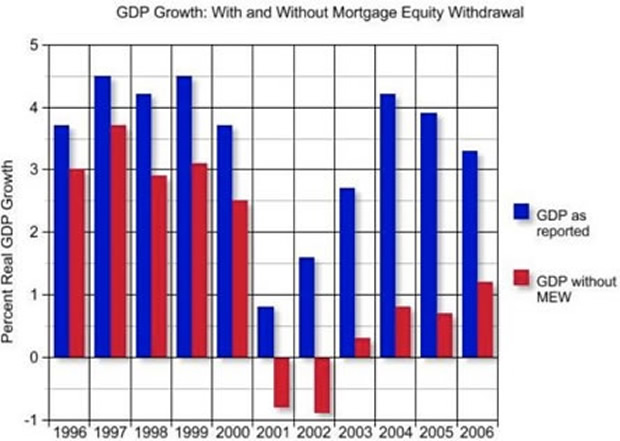

Perhaps so, though I'm sure there's lots of exceptions. Problem is, I don't think McCain is one of them. It is important to view his comments in the context of his agenda, which is as unempathic as his gaffes. As I pointed out last week (see Figure 1 here), his tax plan delivers by far the biggest boost to the average incomes of the richest households; Obama's plan does the opposite. McCain really does double-down on Bushonomics, which takes the inequities inherent in today's market outcomes, and injects them with a dose of steroids.

From this perspective, the problem isn't that he's rich. It's that his wealth is part of a package that strongly suggests he can't relate to the economic struggles faced by so many people from households that don't reside in the top "fractiles" of the income distribution. And if you can't relate, you're much less likely to craft and move a policy agenda that will help, a shortcoming we've seen much too much of in recent years.

This whole dust up reminded me of a CNBC spot I was on with Phil Gramm when he was still McCain's top economic advisor. He was going on about the supply-side, trickle-down nonsense that fits ever so neatly into these guys view of wealth. Arguing his case, Gramm said something like, "I've never been offered a job by a poor person. Have you?"

If government helps rich people, so goes this mythology, they'll unleash a torrent of economic activity that they're sitting on now because tax rates are too high. Cut the regulations that bind them, the taxes that squelch their incentives, and they'll not just lift their own economic fates, but those of the least advantaged as well.

The evidence, of course, points precisely in the opposite direction, but, and here's the kicker, these folks are impenetrable to evidence, and I fear their privileged positions make them so. Their wealth insulates them from reality in a way that you don't see from the other rich folk noted above.

It's not just that McCain can't relate to have nots, it's that he doesn't really want to. He wants to pull the levers that Phil Gramm and others tell him work best, and since he doesn't relate to folks who know very well how many homes they own -- though they may be uncertain whether they'll own them next month -- he lacks the motivation to question whether these levers actually work.

I don't care how much money our president has (though the seven homes thing really does seem beyond the pale given today's housing climate). But I deeply want him or her to understand the economic plight of those with less, and the evidence regarding the policies allegedly designed to help. When their wealth operates like empathy-killing blinders, then that wealth is a problem...a big one.

To listen to McCain last week, and to do so while poring over his policy agenda, really does suggest the dangerous degree to which he's out-of-touch. The Obama folks are right. We'd better work to keep him out of yet another house: the white one on Pennsylvania Ave.

Politicians Talk Tough About Obscene Executive Pay, But Where Are the Fixes?

By Sarah Anderson, AlterNet

Posted on August 25, 2008

During the political party convention season that begins this week, you won't hear much disagreement on one issue: executive pay.

Politicians from both parties finally appear to be seeing which way the wind is blowing on this one. Last year, a Financial Times/Harris poll revealed that 77 percent of Americans think chief executives "earn too much." And that sentiment has likely intensified in 2008, with one banker after another walking away from the mortgage mess with overflowing pockets.

The presidential candidates have responded to public outrage over bloated CEO pay by promising to boost shareholder power over executive pay packages. Barack Obama is the sponsor of a Senate bill that would grant shareholders a nonbinding advisory vote each year. John McCain has suggested he'd like shareholders to have veto power.

This reform, widely known as "say on pay," could shame some boards away from offering truly obscene pay packages. But when shame goes up against corporate greed, we all know which one usually prevails.

The candidates should be giving more attention to proposals that focus on eliminating the various tax loopholes that currently subsidize excessive executive pay.

Obama is supporting a fix for just one of these, the "carried interest" loophole. This is the one that lets buyout kings like KKR's Henry Kravis (personal net worth: $5.5 billion) pay a lower tax rate than their secretaries. Private equity managers get away with this by claiming the profit share portion of their compensation as capital gains, a neat maneuver that cuts their tax bill from 35 percent to 15 percent.

When financial royalty like Kravis don't pay their fair share, the rest of us common taxpayers get stuck with the bill. The annual cost of that particular loophole: $2.7 billion, according to Congress's Joint Committee on Taxation.

And that's just one of numerous tax loopholes that shift the financial burden for our country's infrastructure, education and other needs from the ultrarich to the middle class.

According to a new report by my organization, the Institute for Policy Studies, and United for a Fair Economy, average U.S. taxpayers subsidize executive compensation to the tune of more than $20 billion per year.

Other beneficiaries include guys like Kenneth Griffin, the head of Citadel Investment Group, who made $1.5 billion in 2007. Like most hedge funds, Citadel has a subsidiary in a tax haven, in this case, Bermuda. Such offshore investment vehicles make ideal locations for fund managers to stash boatloads of money in tax-deferred accounts.

While ordinary Americans have strict limits on how much they can set aside in 401(k) plans, hedge fund executives can funnel unlimited amounts into these offshore pots, where their dollars grow and grow, untaxed, until they start withdrawing from them.

Congressional research shows that this widespread tax avoidance scheme costs taxpayers more than $2 billion annually.

Griffin hasn't revealed how much he personally might have shielded from the IRS through his offshore subsidiary, but the multibillionaire admits that his work ethic would whither without low taxes. "I am proud to be an American," he told the New York Times last year. "But if the tax became too high, as a matter of principle, I would not be working this hard."

To defend their preferential tax treatment, Griffin, Kravis and other magnates have dispatched armies of lobbyists to Capitol Hill. Griffin is also hedging his political bets, hosting fundraisers for both presidential candidates and acting as a "bundler" to collect more than $50,000 for each.

So far, their "Save our Subsidies" campaign is working. The five key bills to plug executive-friendly tax loopholes are all languishing. In part, this may be due to the fact that members of Congress know they would face an almost certain presidential veto. In 2009, with a new face in the White House, prospects for this legislation could change.

The bipartisan attacks on runaway pay are encouraging. But if the candidates are serious about change, they should vow to plug every single loophole that allows our tax dollars to flow into the pockets of top business leaders. Surely, in these troubled economic times, we can find better ways to spend our nation's wealth.

Sarah Anderson is a co-author of "Executive Excess 2008: How Average Taxpayers Subsidize Runaway Pay," published by the Institute for Policy Studies and United for a Fair Economy.

Contact: Linda Lampkin, Research Director

PH 877-799-3428

Linda.lampkin@erieri.com

Executive Bonuses Increase Over 100%, According to ERI Economic Research Institute/CareerJournal.com Study

NEW YORK, NY AND REDMOND, WA - May 23, 2007 - Rather than continually increase base salaries, the trend is for companies to tie executive compensation to performance, according to the May 2007 Executive Compensation study released by the Economic Research Institute and CareerJournal.com, The Wall Street Journal’s free career site for executives, managers and professionals. The study found that the average dollar amount of executive bonuses increased 119.9 % since 1997, while base salary for the top executives increased by 37%. Companies are keeping base salaries relatively steady and providing additional compensation in the form of bonus payments, stock options, restricted stock awards, and long term incentive plans.

Top executives in the United States saw the average dollar amount of their 2007 Total Compensation Package increase by 16.5% compared to May 2006 levels. Base compensation remained fairly steady, with an increase of 0.85% compared to the same period one year ago. However, the average company annual executive cash bonus increased by 23.63% compared to a year ago, according to the May 2007 Executive Compensation Index.

"Excessive executive compensation has been a hot topic in Washington, D.C. and the data shows some shifting away from base pay and annual cash bonus," said Dr. David Thomsen, Director, ERI Economic Research Institute. "More corporate boards are tying compensation packages to performance through Incentive Plans, Stock Options, Restricted Stock Awards, and Long Term Incentive Plans."

The May 2007 ERI/CareerJournal.com ERI Executive Compensation Index results are:

Base Salaries

The average increase in base salaries was 0.85% during the last year. Among all the top executives, the annual base salary averaged $1,281,464.

Annual Bonus

The average executive increase in bonus amounts was 23.63% during the last year. Among all top executives, the annual bonus averaged $3,474,711.

Total Cash Compensation

The average executive increase in Total Cash Compensation (base + bonus) was 16.53 %. Among all top executives, the average annual Total Cash Compensation averaged $4,756,357.

Total Cash Compensation Change Since 1997

The May 2007 Company Average Index of Total Cash Compensation is 204.2, using the 1997 level base of 100. Since 1997, the Average Company Percent increase in Total Cash Compensation for the highest paid executives is 104.2%.

Compensation and Revenue Changes Since 1997

The Average Index of Corporate Revenue is 219.8, using the 1997 level as a base of 100.0. Since 1997, the Average Company Percent increased in Revenues is 119.6%. This compares to the increase of 104.2% in the Index of Total Cash Compensation.

A review of the year-to-year data shows a change in pattern from 1997 to 2007. Prior to 2002, compensation was rising at a faster rate than revenues, but in more recent years, executive compensation is rising more slowly than corporate revenues. The May 2007 Index shows a continuation of this trend.

The Total Cash Compensation Index reflects data from a representative group of 44 publicly traded companies randomly selected from the approximately 6,500 companies that report compensation data to the Securities and Exchange Commission (SEC). The May 2007 index has been adjusted to reflect merger activity which has occurred since the inception of the index. The Index has tracked pay for the highest paid executive in this group of companies since 1997.

About CareerJournal.com

CareerJournal.com is The Wall Street Journal's award-winning career site targeted to executives, managers and professionals.

About ERI

ERI Economic Research Institute is a leader in compensation and performance metric information. Based in Redmond, Washington, ERI provides salary survey and cost-of-living research reports and software to over 15,000 organizations worldwide. With information gathered from online surveys and an extensive survey library, ERI provides subscribers with assessments on salary, relocation, the cost of living, and executive compensation. ERI's data covers the United States, Canada, and the United Kingdom and EU. Its industry-leading Executive Compensation Assessor® & Survey software reports executive cash compensation based on information from private executive pay surveys, as well as publicly-reported information for 6,500 US, 1,150 Canadian, and 2,300 UK and EU publicly-traded organizations. For analysis of executive pay in tax-exempt organizations, see ERI’s Nonprofit Comparables Assessor™& Tax-Exempt Survey software, from the ERI database of 28,000,000 measures from over 485,000 organizations. Visit www.erieri.com to learn more about ERI and to review its other talent management and compensation indices.

Posted August 24, 2008 | 04:54 PM (EST)

Jared Bernstein