Clifford Krauss reported from Houston and Julia Werdigier from London.

The Republican Party has decided that the way to win over disenchanted voters this campaign season is to stir up anger on gasoline prices. The GOP answer: Drill like hell on the outer continental shelf and in the wild reserve of Alaska.

Sen. John McCain and President Bush are pinning the blame for those running numbers we see on gas pumps on Democrats in Congress. It is a charade.

Almost in a postscript whisper, the Republicans admit it will be years before new drilling would bring any relief. (Even by conservative estimates, it could be nearly 10 years.)

But never mind. Since the GOP is wallowing in low poll numbers, scandals in the Senate, and a lame-duck president who seems to be reeling in inconsistency, the gasoline issue is the No. 1 public enemy.

In truth, the failure to reach a comprehensive energy policy in the United States belongs to both parties. It has been a part of the unwillingness to reach some sort of reasonable compromise between the drillers and the environmentalists.

Even T. Boone Pickens, the legendary megamillionaire oilman from West Texas and a right-wing Republican to the core, has had an epiphany. In case you've missed it, Pickens has paid for an expensive ad campaign to promote wind as a alternative. He admits that drilling is not the total answer to our growing problem of reliance on costly oil imports, including from the Kingdom of Saudi Arabia.

Pickens was one of the sponsors of the Swift Boat smear against John Kerry's Vietnam War record in 2004. The voters swallowed it for a ticket headed by a safe Air National Guardsman (Bush) and a five-time deferment student who escaped the war (Cheney). Maybe Pickens is trying to atone a little for that cruel tactic.

For their part, Democrats in Congress say there is ample acreage available for drilling already and have issued a renewed appeal for a release of oil in the strategic reserve supply. Alternate sources like wind, sun, and geothermal are other avenues.

When you drive up to the gas pump today, Republicans want you to take out your anger on those whirling numbers by remembering to vote their way in November. They should remember the picture of a startled President Bush when he was told at a news conference that gas could reach $4 a gallon or more.

Yet, an out-of-touch president and his would-be successor want you to believe it is all the fault of Sen. Barack Obama and the Democrats. What a sad commentary on leadership!

April 9, 2008

Two of the world’s biggest oil companies, BP and ConocoPhillips, joined forces Tuesday to try to break a longstanding deadlock over Alaska’s vast reserves of natural gas. They said they would spend billions to build a pipeline from the North Slope to feed energy-hungry markets in the United States and Canada.

The proposal won praise from Alaska’s governor, Sarah Palin. “It’s a good day,” she told reporters in Alaska.

The announcement comes at a time when consumption of natural gas in the United States is increasing and conventional production is declining. Natural gas is cleaner than other power sources, like coal, and analysts say it is becoming increasingly critical to the nation’s energy needs.

BP and Conoco will initially spend $600 million in the next three years to drum up support for the project, seek state and federal approval, and secure gas supplies for the pipeline. BP and Conoco said the project would be the largest-ever private sector construction project in North America.

The project, which would include a $5 billion gas-processing facility on the North Slope, would cost about $30 billion and take at least 10 years to complete.

At a time when both energy prices and construction costs are soaring, the endeavor would dwarf the 800 mile trans-Alaska oil pipeline, a momentous project completed in 1977 and that brought jobs and revenue to Alaska. As oil production from the Prudhoe Bay field declines, Alaskans are hoping that natural gas will take over from oil.

An Alaska gas pipeline has long been sought as a critical component of the nation’s energy security. The planned pipeline would have a daily capacity of 4 billion cubic feet of natural gas, or almost 7 percent of current United States consumption.

But the companies will have to overcome some huge hurdles, said Christopher Ruppel, an energy analyst at Execution, a brokerage and research firm.

“We’ve had a long record of Alaska pipeline projects coming out of Alaska and Canada, and they have consistently been delayed because of political opposition and rising costs,” he said. “The United States and Canada desperately need the gas. But the question is, is it doable?”

The companies will need to secure more than 1,000 permits from local, state and federal authorities in both the United States and Canada, a process that will most likely take years. They need to negotiate with native tribes along the pipeline’s route to secure the right of way. If the oil pipeline is any guide, the gas line will also require vast engineering feats.

But with higher prices, and a growing appetite for natural gas, the economics of such a large project are starting to make sense for oil companies. The companies said the initial plan is to build a 2,000-mile pipeline from Alaska’s North Slope to the Canadian province of Alberta; that would add to the total North American gas supply, freeing some Canadian gas for export to the United States. Eventually, the pipeline might be extended 1,500 miles, to Chicago.

“This will be a massive undertaking,” said Doug Suttles, president of BP Alaska. “It is going to take the big team to get this going.”

The plan to build a natural gas pipeline to export the state’s vast gas resources has been tangled in Alaskan politics for years. Today, Alaska’s estimated 35 trillion feet of gas reserves are either re-injected into oil fields or left dormant because of a lack of export facilities to bring them to consumers.

When Governor Palin took office in late 2006, she interrupted pipeline negotiations that her predecessor, Frank H. Murkowski, had been pursuing with the North Slope oil operators, BP, Conoco and Exxon Mobil.

She started from scratch after criticizing the previous talks as not being competitive enough, and sought to bring in new operators in order to secure better terms for Alaska. Her administration is evaluating a proposal made by a Canadian pipeline operator, TransCanada.

But the oil companies complained about the delays and said the governor’s procedure was unrealistic. Eschewing $500 million in potential subsidies from the state, BP and ConocoPhillips declared on Tuesday that the economics of natural gas have reached the point that they can finance the pipeline on their own.

James L. Bowles, the president of Conoco Alaska, said that while the companies would seek no state subsidies, they will try to meet requirements outlined by Alaskan authorities, like offering local delivery points on the pipeline to meet the state’s natural gas requirements.

“This project is moving forward on its own,” he said.

Ms. Palin welcomed BP’s and Conoco’s proposal, while stopping short of formally endorsing it. She told reporters that she would meet with executives from the companies to find out more about the joint project. Still, she added, “it sounds great for the state of Alaska.”

The plan came as a surprise to Exxon, which said it had been invited to participate only a few days ago. The company will now “evaluate all options,” according to Margaret Ross, an Exxon spokeswoman.

BP and Conoco said they would welcome Exxon’s participation.

Many analysts have voiced concerns that natural gas prices would keep rising as domestic demand grows and Canada’s exports fall because of increased consumption there.

Without a natural gas pipeline, the United States will increasingly depend on imports of natural gas in liquefied form, a source that is costly and potentially vulnerable to political instability in the Middle East, Africa and Latin America. Greater demand is already pushing prices higher, and adding to pressure to open deeper waters off the country’s coast for exploration.

Amy Myers Jaffe, an energy analyst at Rice University, said a gas pipeline was badly needed, in addition to the liquefied natural gas projects under consideration. “In the long term it’s not going to mean we are not going to need L.N.G., but we would need a lot more L.N.G. if Alaska does not happen,” she said.

Natural gas consumption rose by 6.2 percent in 2007, to 23 trillion cubic feet, from 21.7 trillion cubic feet in 2006, according to the Energy Information Administration.

Natural gas prices, which averaged $2 a thousand cubic feet in the 1990s, have soared in the last decade. It recently traded at $9.74 a thousand cubic feet on the New York Mercantile Exchange.

While offshore drilling has drawn national attention, less has been made of oil and gas drilling on public land within the continental United States. This despite figures showing the amount of oil and gas drilling on public land has reached a new high. The Wilderness Society recently reported more than forty-four million acres of public lands are leased for oil and gas development.

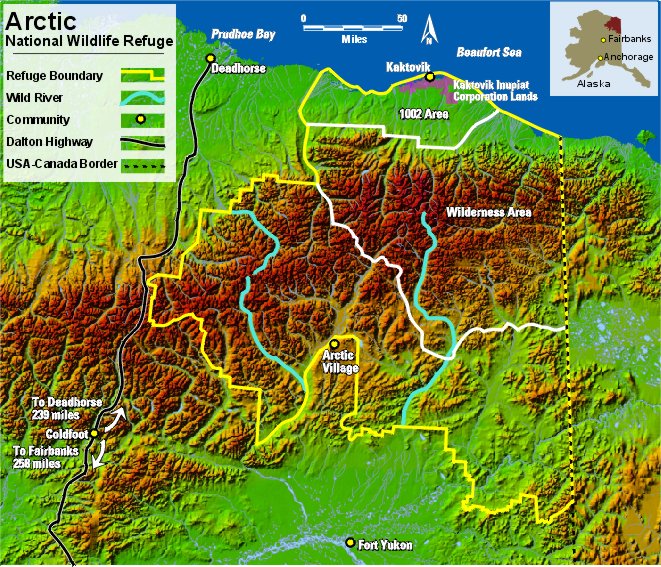

With the rise in gas prices, Americans are facing increasing calls to accept expanded energy exploration at home. Last month, both President Bush and Republican presidential candidate John McCain called for lifting bans on offshore oil drilling. Bush’s proposal included removing the ban on drilling in the Arctic National Wildlife Refuge. McCain says he still supports the ban.*(1)

While offshore drilling has drawn national attention, less has been made of oil and gas drilling on public land within the continental United States. This despite figures showing the amount of oil and gas drilling on public land has reached a new high. The Wilderness Society recently reported more than forty-four million acres of public lands are leased for oil and gas development. Last year the Bush administration approved over seven thousand-one hundred drilling permits, a new record. According to the Wall Street Journal, more rigs are currently operating in the U.S. than at any point in over two decades.

But in states across the country, local residents are organizing to halt what they call the destructive effects of oil and gas drilling in their communities. This includes here in Colorado. Last year a survey of more two-hundred-seventy-five energy companies ranked Colorado as the world’s most attractive investment area for oil and gas exploration. But public backlash has forced a wave of pending measures. These including a three-month ban on drilling in wildlife breeding grounds and revoking more than two-hundred million dollars in tax breaks for the oil and gas industry.

Nada Culver is Senior Counsel at The Wilderness Society, which works to preserve wilderness and other public lands in the United States. She joins me here in Denver.

Nada Culver, Senior Counsel at The Wilderness Society.

*(1) java-Sometimes McCain says he supports the ban:

June 18, 2008

McCain to voters: 'I can give you some relief' at the gas pump

Chad Livengood

clivengood@news-leader.com

PLASTER STUDENT UNION, MSU — Republican presidential candidate John McCain says a short-term suspension of the 18.5 cents federal gas tax on every gallon would help ease the pain consumers are feeling at the pump these days.

“In the short term, I can give you some relief,” McCain told Sarah Craig, a small business owner who told the Arizona senator current gas prices are hurting her bottom line.

“What are you going to do today? What are you going to do next week that helps us now?” Craig asked, repeating a common question among voters these days.

McCain said suspending the gas tax and "maybe" giving taxpayers another economic stimulus check would give Americans short-term relief.

Democrats, including McCain's opponent, Sen. Barack Obama, oppose the tax holiday, calling it a "gimmick" to gain votes from voters frustrated by record gasoline prices, which are about $3.65 a gallon in Springfield today.

U.S. Sen. Claire McCaskill of Missouri said earlier today in a conference call that McCain's plan would cost the state 6,000 jobs and $167 million in federal gas tax dollars for Missouri's roadways.

McCain had a response to that charge.

“A lot of this money that is paid in the form of gas taxes goes to wasteful pork barrel projects,” McCain told Craig during the question and answer session.

McCain also advocated for allowing coastal states decide whether they want to let oil companies drill in ocean waters.

“The decision would still be made by the people of those states," McCain said. "But I certainly encourage them to do so."

McCain has previously opposed increased deep sea drilling off the coasts of Florida and other coastal states.

For years, McCain has opposed drilling for oil in Alaska's Arctic National Refuge Area (ANWR).

But during today's town hall meeting, McCain said he'd be willing to reconsider that stance.

“I would be more than happy to examine it again,” McCain said.

No comments:

Post a Comment