Tuesday, September 30, 2008

'If You Can Run the PTA, You Can Run the Country' -- Republicans Explain Their Support for Palin

By Steven Rosenfeld, AlterNet

Posted on September 30, 2008

Sarah Palin's vice-presidential candidacy has provoked no shortage of strong opinions. But while critics on the left and in the mainstream media have found ample reasons to criticize her, Palin's Republican supporters have their own heartfelt reasons to embrace and defend her candidacy.

In a series of interviews with Palin supporters on Monday before a Bexley, Ohio rally featuring Palin and GOP presidential nominee John McCain, Palin fans detailed many reasons why they like -- if not love -- her candidacy.

They said she was feisty, plain spoken and not afraid to take on fights others shirk from. She was from the middle-class, balanced family and work, and had worked at thankless jobs -- like her local PTA -- and exemplified Christian family values. They said Palin was a fast learner, was undaunted by her critics, and gave hope to women who see her rising to the role given to her by McCain. And, most notably, they said she would be a good president.

"I've been there," said Ellie Plessinger, a real estate consultant from Saganaw, Michigan, who extolled Palin's work on local schools. "If you can run the PTA, you can run the country."

"She's real. Everyone can identify with her," said Karen Rinehart, from Pinkerton, a suburb of Columbus, who praised her clarity. "She has five kids. I have six."

"She is a go-getter. She is adorable," said Diedre Smalley, from Lancaster, also near Columbus, who was enthralled by Palin's values. "She is conservative. She is family oriented. She is pro-life. She is her own woman. She makes me feel proud."

These and other comments reveal that Palin's supporters feel as strongly about her as her liberal critics. In conversations with these and other fans at a rally at Capital College, a Lutheran school in a small township inside Ohio's capital city, it became clear that Palin's political base was formidable and undeterred by her critics and detractors, including editorialists who have said she is unprepared to become president.

"Who is?" replied Rinehart, when asked if Palin was prepared to be president. "You can't say that anybody who has been there has been prepared for it. You are not prepared for it until you do it. Nobody is prepared for vice-president or president until you do it."

"I think he (McCain) is very knowledgeable about defense and security; I don't know how knowledgeable she is about that," she said. "But she has the gumption to learn and do what is right. You don't read about Alaska in the tabloids. You read about Washington and everywhere else. She has kept it clean."

"When she did her (Republican National Convention) speech, I was floored," Smalley said. "They (McCain and Palin) are exactly what America needs right now."

While Palin critics have scorned her experiences as provincial and not world-wise, Palin's middle-class roots and family life pleased these supporters.

"I come from the middle-class," said Plessinger. "She symbolizes the middle class by her story. She wasn't raised like the Kennedys or Teresa Heinz Kerry or the Rockefellers. The richest people in our government are Democrats. It came out last week. John Kerry was the richest. You get the idea that they come into our politics like they are entitled. The drive-by media has made misperception that only the Republicans are elite, or are wealthy."

Plessinger said she was put off by media reports that describe Alaska as "backwards or unsophisticated." She said she, like Palin, has worked on her local PTA "in leadership positions" for many years "for the kids." Plessinger was impressed that Palin not only took on thankless hard PTA fights and won, but that she then sought higher office.

"You have to deal with all kinds of conflicting interests," she said, referring to working for local schools. "People diminish that and say it doesn't matter. Palin was successful. Then she runs for governor and takes on problems in our party. She saw corruption and she stood up to it. She stood up to the oil industry. I know exactly what it takes I wish we had leaders like that in Ohio."

Plessinger was wearing six Palin campaign buttons, including one showing Palin holding a shotgun saying, in pink lettering, "Read my Lipstick: Change is Coming."

"She came from a middle-class family. She did it with conviction and grit," Plessinger concluded. "God's in charge. I'm voting for God first."

Others at the rally were drawn to Palin's accomplishments as a mother and politician.

"She's awesome," said Tracey Chernek, a nursing student from Columbus. "She says what she needs to say without backing down. She is a lot like Sen. McCain. They are very opinionated and they don't back down."

Chernek said Palin's ability to balance work and family were inspiring.

"She has a family and a lot of Americans can relate to that," she said. "She is a working mother. She has kids. She works and she balances it out. A lot of women struggle with that."

Chernek also said she was offended by attacks in the media on Palin's family.

"There is a lot of bad press -- like her daughter who is pregnant at 17. You can't chastise a family for having a daughter who is pregnant at 17. A lot of parents worry about that or have been in that situation themselves. It's part of life. She has a normal family like everybody else. I think it is kind of seamy that Democrats get on her butt about mistakes her daughter made."

"It's her integrity," Smalley said, "what she has done for her state, and yet she is able to have a family, a career, a husband. It just gives woman hope that we can do it. She is sassy and we like sassy."

Perspective, please

Liberal critics will take issue with many of these assertions about Palin's experience, family life, political record and accomplishments. Indeed, many of the traits praised by Palin's supporters came from her Republican National Convention speech that was not written by her, but like all presidential campaigns, crafted by speechwriters to echo the campaign's talking points to the media and voters.

But Palin's critics risk not fully understanding the race's dynamics by underestimating her or her base, just as the GOP risks underestimating the enthusiasm of first-time voters who support Barack Obama. It is not an accident that Palin was chosen by McCain to be his running mate. Indeed, at the Monday rally, while McCain attacked Obama, Palin introduced some new lines of attack -- on Obama and on Joe Biden, the Democratic vice presidential nominee. Palin began by referring to last week's presidential debate.

"He (McCain) was the only man on that stage who talked about the wars America was fighting and was not afraid to use the word victory," Palin said, opening a line of attack that said McCain was the only man in the race. "He was the only man on that stage who will solve our economic crisis and not exploit it, the maverick who always puts country first. And he was the only man on that stage who has a plan that will actually help working families and put the economy back on track like you all deserve. Ohio, that's the kind of man, that's the kind of leadership that we need in Washington and that's the kind of man that we will get if you vote for him."

That part of her speech was reminiscent of California Gov. Arnold Schwarzenegger early months in office when he attacked California Democrats as "girlie men" for not adopting his legislative proposals.

Palin gamely said she was ready to debate Biden this Thursday.

"And I do look forward to Thursday night and debating Sen. Joe Biden," she said. "We are going to talk about new ideas and new energy for America. I'm looking forward to meeting him. I've never met him before. But I have been hearing about his speeches since I was like in second grade."

"I have to admit though, he is a great debater and looks pretty doggone confident like he's sure he's gonna win," she continued. "But then again, this is the same Senator Biden who said the other day that the University of Delaware would trounce the Ohio State Buckeyes. Wrong!"

Palin's remarks brought cheers and jeers, revving up the party's Ohio base in a rally that was attended by several thousand people, half of them college students. While Democrats in the room ridiculed her remarks and those by McCain -- especially his claim that only he was free from special interest money in Washington -- by recalling how McCain was among five senators who were called "the Keating five" in a savings and loan scandal, the mood in the room seemed to transcend any real discussion about facts or history.

Instead, the GOP faithful firmly believed in their view of their party and its candidates. They were excited by Palin's presence -- as measured by cheers. Nobody interviewed praised McCain for being "sassy," or showing "grit," or being a "go-getter" or being inspirational. She spoke for 11 minutes; McCain spoke for 16 minutes.

On Tuesday, with Election Day 35 days away, early voting begins in Ohio. There is a five-day window where new voters can register and vote before the voter registration deadline closes. How many new voters each party attracts in this window will reveal much about the race's momentum in Ohio. That metric, more than the campaign's rhetoric and fervor of supporters, will be the real reality test.

AlterNet is a nonprofit organization and does not make political endorsements. The opinions expressed by its writers are their own.

Steven Rosenfeld is a senior fellow at Alternet.org and author of Count My Vote: A Citizen's Guide to Voting (AlterNet Books, 2008).

Sarah Palin's Extremist Religous Beliefs: The Republic is At Risk

Submitted by BuzzFlash on Tue, 09/23/2008 - 6:49am. InterviewsA BUZZFLASH INTERVIEW

"This is also one of the most aggressive movements in the push to tear down the wall between church and state. They actually go further than many in the Religious Right and believe that their Apostolic structure will become the new authority in the United States and the world. Furthermore, their obsession with driving out demons means that the end always justifies the means. If you are against them, you are working for the devil....This is about their efforts to take control of society and government and they blatantly state their intent to do so."

-- Bruce Wilson of the watchdog website talk2action.org that monitors right wing extremist religious groups

* * *

As always, the GOP dishonestly packages their candidates to hide their true agenda. With Sarah Palin, her most abiding goals appear to be related to her religious beliefs, which made her the chosen vice presidential candidate of the religious right. It was the hardcore end-times fundamentalists who allegedly offered McCain their support if he named Palin to the ticket, which he did without regard for her qualifications.

But what does Palin's religious affiliation hold out were she to become president, which would be a likely scenario -- given McCain's medical history -- were they to be elected in November?

We turned to the people over at one of the most informative sites on religious extremism: talk2action.org, which has several experts posting on the religious and governing implications of a Palin presidency, including Frederick Clarkson, Chip Berlet and Bruce Wilson.

This interview was conducted via e-mail (due to time constraints for publishing it) with Bruce Wilson.

BUZZFLASH: Of the many Christian denominations, what general denomination does Sarah Palin belong to?

Bruce Wilson: Well, if we simply look at Palin's Alaska churches, there's no clear answer - Sarah Palin belonged to Wasilla Assembly of God for over twenty years, up until 2002. The head pastor, Ed Kalnins says she maintains a "friendship" with his church and still attends seminars and special events there -- including speaking at the graduation of the Master’s Commission class this past spring. When she is in residence in Juneau she attends Juneau Christian Church which is also a member of Assemblies of God. She also is currently a member of an independent church in Wasilla. So it might seem appropriate to peg Palin as being in the Assembly of God but that would be very misleading, because both of those churches are in a non-denominational movement that's independent from, and actively trying to take over, not only the Assemblies of God but all other branches and denominations of Christianity.

BUZZFLASH: Within that denomination, is she an adherent of a particular type of theological movement?

Bruce Wilson: Journalists who simply try to answer the question as to what Sarah Palin's denominational affiliation is are completely missing the point. Just because a church is attached to a particular denomination doesn't mean it teaches that denomination's official religious doctrine. I've been working in a research team that has put in probably hundreds of hours into studying what goes on in her churches as well - listening to sermons, identifying guest speakers and seminar leaders, analyzing church curricula. To know what a church believes, look to what it teaches kids and young adults. On that basis, we can show Palin's churches teach believes well out side of the traditional Assemblies of God teachings.

What our research tells us is that both of Palin's Assembly of God churches are deeply involved in a movement called the Third Wave or New Apostolic Reformation, a religious movement in Christianity that's been gathering force for the last several decades and which rejects denominationalism completely.

Third Wave beliefs are so different from traditional Assemblies of God belief that the national body of the Assemblies of God denounced Third Wave beliefs, in 1949 and again in 2000, as heresy. I can’t say with certainty what Palin personally believes but she certainly has been extensively exposed to the Third Wave worldview and theology.

It's a movement that claims, under the rubric of Christian unity, that all Christian denominations are invalid--their members aren't true Christians or, at least, they aren't truly saved. This is a sort of hyper-fundamentalism which thinks that not only all Protestant denominations, but the Catholic Church as well, aren't valid expressions of Christianity. And, not too surprisingly, the movement thinks all other religious and philosophical belief systems on earth are invalid too and even under demonic influence.

I have been writing about this regularly at Talk2action.org and have posted two videos on the movement and the ties to Palin’s churches. This movement is drawing from many different denominations, not just Assemblies of God, but these particular churches happen to be very well connected to the Third Wave/New Apostolic Reformation movement. Just to add a wonkish note - we're using those terms because those are the terms that both the movement and its critics (and there are lots of them) within fundamentalist Christianity use. The Third Wave is part of a movement that's been around for decades, but the New Apostolic Reformation is very, very recent -- it's come out only in the last decade or decade and a half. But it's growing explosively.

BUZZFLASH: What are some of the more extremist views of this movement?

Bruce Wilson: Well, they believe in raising up an "end-time" last-generation army that will cleanse the world of evil, as they themselves define it. They also say that believing Christians can develop the power to raise the dead. And, they're not waiting around for the rapture.

Now, even though the idea of the Rapture may still seem new and shocking to some Americans, that idea is really part of long standing, orthodox Assemblies of God belief. Unfortunately, much of the press has drawn the conclusion from her denominational background that Palin believes in the doomsday end time narrative in which the born again believers are waiting to be suddenly yanked from the earth in the Rapture and everyone else will be left to the mercy of the Antichrist.

We’ve heard a lot about this theology in recent years with the attention to the Left Behind Series and televangelists like John Hagee. But Palin's churches, particularly Wasilla Assembly of God where Palin has spent most of her adult life, have a much more aggressive theology. They haven’t completely discarded some of the narrative of the Rapture but they have a very different spin on it. In their version, the end time church is going to a great conquering power -- sort of like the Tribulation Force in the Left Behind books -- but they are starting now [here on earth through seizing governmental power].

BUZZFLASH: Most Americans believe in the separation of church and state and follow their religious beliefs but do not impose them on others. Does Palin's church believe that it is its mission to convert others to its religious outlook?

Bruce Wilson: The short answer to that is - they reject separation of church and state altogether.

The longer version is: they're working to bring about a Christian theocratic government which, writes head of Morningstar Ministries Rick Joyner, “may seem totalitarian at first.”

Once again, they are not waiting around for the Rapture. In that doomsday scenario the true believers escape the world before the violence really gets going and the ungodly are ultimately destroyed. The danger in that theology is that since they believe the world is spiraling to a terrible end anyway, why bother preserving the environment? Also, they find everything from war to natural disaster quite exciting because it means the Rapture is near. So, for instance, Hagee very blatantly preached to his congregation that the Iraq war would bring about the Rapture.

Third Wavers, on the other hand, believe that God is anointing them with special powers in order for them to battle the ungodly themselves, and that Jesus can’t actually return until they have finished conquering the world. This is actually a much more aggressive endtime belief than the one that people are attributing to her, and it means that journalists are asking the wrong questions.

The central figure in this movement named it the New Apostolic Reformation about a decade ago because they believe that they will conquer the world by conducting spiritual warfare around the globe to expel demons and transform cities. In order to do this churches are supposed to be reconstructed under the authority of Apostles and Prophets anointed for those roles by God. They believe that all other churches and religions that don’t accept this outpouring of supernatural powers and join their battle are obstacles to their mission. And, it doesn't stop with "spiritual warfare" - they believe the battle in the spiritual realm precedes the physical realm and their army of God is networked all over the world from Kazakhstan to Korea, preparing to battle the ungodly.

BUZZFLASH: You have collected and disseminated over the Internet available footage from Palin's church. What are some of the more provocative things that you found in viewing the videotapes?

Bruce Wilson: My video clips are mostly from Wasilla Assembly of God and its Master’s Commission program, from Morningstar Ministries and of Bishop Thomas Muthee. Wasilla Assembly of God and their pastor have very close ties to Morningstar and Muthee's ministry, and both are major players in the Third Wave. The video and other videos which I and my research team have linked to in our articles, show things like people making cell phone calls to zap their friends from a distances, to 'anoint' or "slay them in the spirit'. There's healing through expelling demons, Holy Laughter, etc.

In some of the video clips, Wasilla people talk about learning to raise from the dead. In an audio of a sermon, by Wasilla's head pastor Ed Kalnins, he leads his church in a frenzied, building song (there's a heavy bass guitar accompaniment) about "breaking the back of the enemy." It's supposed to be about internal spiritual struggle. He also declared a "Jehu Anointing" on his church. Jehu was an Old Testament character who violently dealt with Jezebel, who had brought Baal worship to Israel. Jehu ran her over with his chariot, her blood spattered the walls of the temple, Jehu's soldiers slaughter the 400 Temple priests of Baal - and so on.

One recent speaker at the Wasilla Assembly of God described his young kids as his "Bin Ladens" - and he seemed quite serious about that. In one of the video clips from Morningstar Ministries, the Morningstar Executive Vice President Steve Thompson shouts to his audience about how Jesus is waiting until the enemies of God are put under the feet of the body of Christ.

This movement shouldn't be taken as some sort of circus. It knows how to have fun, and it doesn't let down its hair because its hair is down to begin with. But, it's anything but casual - rather, it's very, very serious and focused on conquest.

The manifestations that you see in their worship amount to their growing divine empowerment, with supernatural abilities, as part of an end-time army for God. The army is referred to in the movement as Joel’s Army or Gideon’s Army and they are particularly successful in attracting young people. Keep in mind that much of religion in this country today, particularly from what we call the Religious Right, is direct marketing. You don’t just get it from your church but from television, all kinds of media, and participation in the kind of youth events that this movement is holding all over the country. These events are something like a cross between church and a Grateful Dead concert and the message has a great appeal to young people. They have music - often really good music - and free form dancing, lots of atmospheric lighting - it's very sensually oriented. People can dress pretty much as they like - it's very casual - and there aren't many strict behavioral rules if it falls in the realm of spiritual expression.

BUZZFLASH: Of the many peculiar and atavistic views held by Palin, she is among the extremists who is opposed to even teaching abstinence education because it implicitly raises the issue of sex. How does one come to this bizarre perspective, especially considering that Palin herself was allegedly pregnant when married and her teen daughter became pregnant and is still not married?

Bruce Wilson: This movement is also rabidly anti-choice. If you ever saw the movie Jesus Camp, where the kids hold little plastic fetuses and scream and cry, then march in D.C. with tape over their mouths – that was this movement. Becky Fischer was with Morningstar Ministries and Lou Engle, who took the kids to DC, is a Prophet in one of the inner circles of leadership. They are so focused on the evil of abortion and fighting teaching kids about contraception that the use of birth control can become more of an evil than the sex itself. The bio of one of the junior pastors at another church that Palin has attended, states that he has taught abstinence in public schools.

BUZZFLASH: Although Palin is part of a distinct sect of Dominionism believers, can you explain how Dominionists believe that all the resources and environment of the earth were put here to be used up by men and women without concern for conservation? Does this relate to End-Times adherents?

Bruce Wilson: This is another place where journalists are missing the boat. The doomsday endtime believers were not at all concerned about the physical earth and therefore didn’t care about global warming or limited resources. The Third Wave puts a slightly different spin on this. They are planning to take control of the world so they do have some concerns about the environment. However, they again believe that you do this through the expulsion of demons. Our research team recently posted a story on the Transformations videos. This is where the story of Thomas Muthee chasing the witch out of Kiambu was originally told. Muthee anointed Palin before she became governor. The Transformation video also demonstrates their belief that you save the environment through this same spiritual warfare. This video and other examples that they use supposedly show that you can save the earth, and have supernaturally large harvests, after the territorial demons are expelled and the area is thoroughly Christianized with their type of belief.

It is reported that Palin won her bid for mayor of Wasilla because she ran on an anti-abortion platform, bringing in religious and culture war issues to a race in which only a few hundred votes were cast. Is there any reason to believe that she won't seek to impose her religious beliefs on America were she to become president?

BUZZFLASH: No. This is also one of the most aggressive movements in the push to tear down the wall between church and state. They actually go further than many in the Religious Right and believe that their Apostolic structure will become the new authority in the United States and the world. Furthermore, their obsession with driving out demons means that the end always justifies the means. If you are against them, you are working for the devil. The New Apostolic Reformation has a current campaign called Seven Mountains. My research team will be reporting on this soon on Talk2action.org. This is about their efforts to take control of society and government and they blatantly state their intent to do so. The seven mountains are religion, family, education, arts, media, government, and business. They believe that once they take full control of these seven mountains they will be well on their way to conquering evil in the world.

This means that they see everything from science to foreign policy through the paradigm of combating what they call powerful territorial demons. They soft pedal this by saying they are fighting the demons not people through strategic level spiritual warfare. However, the example of Muthee driving out the witch and many other Transformations stories demonstrate that they are not squeamish about imposing their will on others. This is the ultimate in faith-based policy. If you drive out the demons and set up your Christian community under the authority of God-anointed Apostles and Prophets, your social and environmental problems go away.

BUZZFLASH: If so many journalists including others who cover religion are getting this wrong, how do you have this information?

Our small research team happened to have been working for several months on a related story. My colleague, who writes under the name Ruth on Talk2action.org, has spent the last six years specializing in Christian Zionism. We were working on the involvement in John Hagee’s Christians United for Israel, CUFI, by a number of major Apostles and Prophets in this movement, including the hosting of joint events attended by churches and Jewish leaders. Without going into a lot of theological details, the doomsday endtime scenario required that Jews move to Israel and rebuild the Third Temple. Like you can see in the other examples, this shifting theology also means changes to the meaning of Christian Zionism and we have been working to document those changes.

The movement in its current organized state is also quite new and that makes it hard to report. Also, it sees itself as the unified church of the end times so they resist being easily labeled as a denomination. Strands of this movement have been around for decades, and it is actually a revival of a movement from the 1940s, but what has happened in just the last ten to fifteen years is that the movement has become better institutionalized. It has also managed to take over large numbers of Pentecostal and independent churches. For instance, they credit themselves with bringing the Australia Assemblies of God around to their theology, and that denomination has recently changed its name to the Australian Christian Churches. The leader of the denomination during much of this transition then went on to found Australia's Family First Party. In addition to the Apostolic network that we've been writing about, there are many others around the world that are networking together and share the same theology, and interconnect through revivals, schools, media, etc.

Despite the fact that this movement appears to be invisible to most people, it is well known to some other Evangelical groups. There are hundreds of internet sites documenting their activities and a lot of controversy about their animosity toward other churches that refuse to join in their beliefs and their embrace of a very hypercharismatic style of worship.

We had spent many hundreds of hours on this, so we were very familiar with the New Apostolic Reformation and its leadership before Palin was named. The movement has very unique characteristics including its own very colorful lingo. They use a great deal of militant terminology and have given names to various aspects of their spiritual warfare efforts and operations. We immediately recognized that Palin’s churches were plugged into the movement’s top organizations and leaders, and have been working around the clock to try to get this information out to the public. Again, we cannot speak for what Palin thinks, but we have now digested hundreds more hours of sermons, videos, curriculum, etc. and feel confident that this movement has at least had some impact on her world view. Regardless of Palin’s future in politics, this is a story that needs to be out there because this is a rapidly growing threat to the separation of church and state.

* * *

Resources:

http://www.talk2action.org/

The Laughing Church: http://www.youtube.com/watch?v=7_CkZWTvKBc

Is Palin's Church a Cult? http://vimeo.com/1679097

How Ya Doin'?

Long before anyone had been nominated or elected, the voters of 2008 had gotten one message across loud and clear: Fix our dysfunctional health care system! For obvious reasons (and big reasons that aren't so obvious), the leaders of 2009 must heed that call.

America's health care system is in meltdown. More than 45.7 million of us have no health insurance. But even those with good insurance face rising costs and a growing risk of losing the protection they have. Every year, tens of millions of Americans go uninsured for long periods — when a layoff, a divorce, or illness itself disrupts their ability to get or pay for coverage. (Forty-one percent of working-age Americans making $20,000 to $40,000 per year lacked insurance for at least part of 2007.) Still more millions are seriously under-insured, though many don't realize it since insurance companies tend to be secretive about the conditions and procedures they refuse to cover — until we actually need the care.

In an economy that's gone bad and getting worse, countless American families — insured and uninsured alike — live in dread of being plunged into poverty or destitution by a major health problem.  In fact, more than half of all individual and family bankruptcies are triggered by medical bills.

In fact, more than half of all individual and family bankruptcies are triggered by medical bills.

Health care is a momentous problem in its own right. It's also hugely important as part of the broader breakdown of economic security in our country, and as a symbol of political gridlock and unresponsive government. For all these reasons, it's an issue to be addressed boldly, decisively, and, at the same time, with an extra measure of care.

If we were starting from scratch, "single payer" might be the way to go. With one public insurance plan covering everyone, Americans could potentially realize hundreds of billions of dollars a year in savings on pointless bureaucracy and profits — more than enough to cover the uninsured and improve coverage for tens of millions of under-insured.

But we are not starting from scratch. During World War II, U.S. employers began providing health insurance as a way to attract scarce workers at a time of strict wage-price controls. Tax laws went on to codify our employer-based system, which even now provides health care for 160 million Americans — a majority of those not on Medicare. Their support was the critical missing piece in 1993. That's when the Clinton administration set out confidently down the path of health care reform — only to see its proposal cut to shreds by insurer-sponsored TV spots in which a middle-class couple called "Harry and Louise" warned of a sinister plot to "force us to pick from a few health care plans designed by government bureaucrats."

The good news is that Americans are much more suspicious of the insurance industry now than they were then. Many people have wised up to the way insurers compete by cherry-picking younger, healthier workers and employing armies of agents to deny claims — sometimes even when it means condemning someone to premature death or a lifetime of chronic illness. Of all the world's nations, the United States spends by far the most money on health care per capita and in total. Our health care system is enormously wasteful and chaotically organized — and Americans know it. About two-thirds of all voters are prepared to see taxes increase in order to provide high-quality health insurance for everyone. Even a majority of those who are satisfied with their coverage now grasp the need for major reform.

The sticking point for many, however, is the ability to keep the insurance they have. The answer is to guarantee that option, building it into a plan that also lets people choose from a menu of private insurance alternatives (with regulated benefits and costs) or sign up for a Medicare-like public plan, which can act as a benchmark for its private competitors. That's the concept behind Health Care for America, a proposal put together by the political scientist Jacob Hacker with the support of the Economic Policy Institute.

Health Care for America is simple and flexible enough to appeal to a majority of Americans, but bold enough to do the job of covering everyone and controlling health price inflation. And it holds the promise of becoming better over time, as more and more Americans shift over to the public plan, lured by its higher efficiency and more generous benefits.

Excerpted from New Progressive Voices: Values and Policies for the 21st Century [1], by the Progressive Ideas Network. Read the full chapter or download the PDF here [2].McCain's Health Plan: You're on Your Own

By Jared Bernstein, Huffington Post

Posted on September 29, 2008

With less than 40 days to go until the presidential election, let's assess where things stand.

Obama appears to be building an edge in the polls and has some upward "mo." That said, the election appears to be a lot closer than it should be given this fact: on two of the issues that concern voters the most -- the economy and the war -- the policies of the Bush administration are widely viewed as dismal failures. Yet McCain's plans are clearly an extension, if not an "amping up," of precisely those policies.

There's a third issue of great concern -- health care -- which should also favor Obama, but it hasn't been discussed much, something I'll try to rectify in a moment.

Another reason the election feels closer than it should be is the strange, erratic, even histrionic campaign being run by McCain. Most recently, it's the "economy's fundamentals are sound," the whole "will-he, won't-he" on the first debate, the distracting, self-aggrandizing way he placed himself in the bailout debate, the politics-first choice of Palin. It all points to the kind of unpredictable, seat-of-your-pants, gut (vs. reality)-driven leadership style of the last eight years.

And, as noted above, his policies seem to derive from a meeting where he and his advisors took a close look at the last eight years and said, "Damn, that's good. Let's double down."

You might think that voters who haven't already made up their minds would look at these bad policy choices along with all this recent flailing about, and feel more than a little squeamish about handing the reins to this team.

Yet, it's close. There are lots of reasons for that and I won't try to sort them out. One factor that has perhaps been under appreciated is that even now that folks are starting to pay attention, they often don't believe that the candidates will do what they say they're going to do. If that's the case, why bother listening to their differences (negative campaigning is effective here as well)? Better to make the call based on gut reactions.

That's a mistake. Both candidates will put great effort into implementing their plans. When John McCain says he's out to cut corporate taxes by a third and pursue "victory" in Iraq, I believe him (a Democratic majority in Congress would try to block him, but I don't want to bank on their success).

So, with no disrespect to gut reactions, and to complement the beginning of the debating season, I recommend we head for the weeds to take a closer look at the other big issue of voters' minds: health care.

The current system is unraveling...that much is known. And the two candidates have very different plans to fix it. Here are some things voters should know about them.

McCain: A $3.6 Trillion Tax Increase and a Shove Into the Open Market

In the first presidential debate, McCain argued that he wants every family "to have a $5,000 refundable tax credit so they can go out and purchase their own health care." To which Obama later responded: "... you may end up getting a $5,000 tax credit. Here's the only problem: Your employer now has to pay taxes on the health care that you're getting from your employer. And if you end up losing your health care from your employer, you've got to go out on the open market and try to buy it."

You see, the 140 million of us who get health care for ourselves and our families through our jobs do not pay taxes, either income or payroll, on this part of our compensation. The McCain plan ends that exclusion, and thus becomes a $3.6 trillion tax increase over 10 years on workers. What was a tax-free part of your compensation is now taxable income. You'll pay income tax on it and you'll pay payroll taxes on it.

Once that happens, your employer's incentive to offer coverage is diminished, and experts estimate that around 20 million people will lose employer coverage.

So, you're thinking: Wait a minute. McCain's health care plan makes part of people's income newly taxable and that leads to millions losing health coverage. That can't be all there is to it.

Of course not. As he said in the debate, he'll take that revenue from the tax increase, and give it back to you as a tax credit, so you can go buy health care on the open market, or as the health care wonks call it: the non-group market (the group market is where your employer shopped for coverage for the group formed by you and your co-workers). In fact, the McCain team claims that the plan is revenue neutral: they taketh by subjecting more of your compensation to the income and the payroll tax, and giveth back through the subsidy.

But there are two very big wrinkles here. First, when it comes to brokering a deal with insurance companies, there's strength in numbers. Shopping for health care in the non-group market is not most people's idea of a good time. They have no obligation to cover you -- you as much as cough in there, and they're likely to have you escorted out. As my EPI colleagues Bivens and Gould wrote in a new paper, "the individual market is characterized by poor information about policies, discriminatory pricing, coverage exclusions, refusal to cover preexisting conditions, and denials of policy renewal. Even worse, other planks of the McCain plan actually call for removing many of the (already insufficient) consumer protections that currently exist." (BTW, see their paper to be the first on your block with an estimate of the number of folks who might lose coverage in your state.)

Second, the McCain subsidy grows at the rate of overall inflation, a rate that is far below that of health coverage on the open market. The average family premium is already around $12,000, so the $5,000 per family subsidy is already judged by many experts as too low to cover the cost of a decent plan in the private market. And since premium costs have consistently risen more than three times faster than overall prices, the McCain subsidy will quickly become more inadequate over time, driving up the number of uninsured.

Obama's Plan: What He (and others) Learned in the 1990s

The health care debate/debacle of Bill Clinton's first term taught health-care reformers a critical lesson: though people are frustrated with the status-quo, we're nervous about the impact of big changes in it. To be able to say to folks, "You can keep what you have" is a big political selling point.

This was a feature of all the D's plans -- Edwards, Hillary Clinton, and Obama. Under Obama's plan, if you're okay with your employer's plan, you keep it. Employers who don't now provide health care have to contribute ("pay or play") to a new public plan, a kind of Medicare for All (small businesses get a tax credit to help them offset the cost). Those without employer coverage can join this plan through a "health insurance exchange" which works as a large pooling mechanism to give this disparate group the bargaining power they lack as individuals.

Insurers in the plan are regulated such that they can't do all that nasty stuff that goes on in the non-group market. The pooling and the insurance regs create some cost-saving efficiencies, and Obama goes after a significant waste of money in the current Medicare plan: the subsidies to private HMOs through Medicare introduced by the Bush prescription drug program -- that saves $150 billion over ten years.

But these cost savings don't pay for the plan and there are no free lunches in health care reform. The Obama plan will involve some serious resources, estimated by the campaign to be in the $70 billion annual range. He pays for it through the war dividend, allowing the high-end Bush tax cuts to sunset, and the Medicare savings just noted.

The punchline: check out the graph on page 3 of this analysis. Compared to the current situation ("baseline"), Obama's plan is expected to cover a lot more of the uninsured, while McCain leaves that share unaffected.

These are but thumbnail sketches of major reforms, but the most important difference here is really philosophical: McCain stresses a market solution to health care. It's a YOYO (you're on your own) move, based on the belief that a bunch of subsidized -- albeit inadequately subsidized -- individuals scurrying around the nongroup market will create cost competition. That might work with normal goods. It won't work with health care.

In fact, McCain recently wrote this very unfortunate sentence: "Opening up the health insurance market to more vigorous nationwide competition, as we have done over the last decade in banking, would provide more choices of innovative products less burdened by the worst excesses of state-based regulation."

Ouch.

I realize that not every voter wants to hear about "insurance exchanges" and "risk pooling" at this stage of the game. But they should know that McCain's plan threatens a very large change in the treatment of heretofore untaxed benefits, a large decline in employer coverage, and a subsidy that starts out too low and grows at about a third the rate it needs to in order to keep up with the costs families face today.

Okay. Let us surface from the weeds and rejoin the rest of the world. But as we do so, let's get the guts working with the brains. If that happens, this election may not be nearly as close as it appears to be today.

Jared Bernstein is a senior economist and director of the Living Standards Program at the Economic Policy Institute in Washington D.C.

Monday, September 29, 2008

Swing District Congressmen Doomed Bailout

This was predictable, I suppose, but it's remarkable to see how strong a relationship there is between today's failed vote on the bailout and the competitive nature of different House races.Among 38 incumbent congressmen in races rated as "toss-up" or "lean" by Swing State Project, just 8 voted for the bailout as opposed to 30 against: a batting average of .211.

By comparison, the vote among congressmen who don't have as much to worry about was essentially even: 197 for, 198 against....

| Monday, September 29, 2008 |

| SPOONAMORE REVEALS THE PLAN TO STEAL THE NEXT ELECTION |

Here, in this shattering new interview, Stephen Spoonamore goes into harrowing detail about the Bush regime's election fraud, past, present and--if we don't spread the word right now--to come. Since he's the only whistle-blower out there who knows the perps themselves, and how they operate, we have to send this new piece far and wide. Here Spoon tells us that McBush's team--i.e., Karl Rove and his henchpersons-- have their plan in place to steal this next election: by 51.2% of the popular vote, and three electoral votes. He also talks about the major role played by the Christianist far right in the electronic rigging of the vote. And he defines our electronic voting system as a major threat to US national security, calling for it to be junked ASAP, in favor of hand-counted paper ballots. Since Spoon is a Republican and erstwhile McCain supporter, as well as a noted specialist in nosing out computer fraud, his testimony is essential--not only for its expertise, but, no less, for the impact that his views will surely have on those Republicans who have been loath to see what Bush & Co. has done to our election system. That whole story's just about to break. In fact, tomorrow there will be a number of articles appearing, on a recent breakthrough in the lawsuit that Spoon's testimony has enabled, and on other aspects of that all-important case. MCM Last week, VR (Velvetrevolution.US) interviewed GOP Cyber security expert Stephen Spoonamore about the upcoming election and his testimony in the new Ohio litigation to take depositions of Karl Rove and others. The video is posted in full below with ten short clips for You Tube viewing. This interview is so important and explosive that we urge everyone to watch it. Spoonamore says that the GOP wanted e-voting to steal elections but now foreign governments will be hacking and the winner will be determined by the best hackers. He says that if the GOP wins the hacking competition, McCain will win 51.2 percent with three electoral votes over Obama, and it will be a stolen election. Spoon also makes a crucial point about the people who have been implicated in much of the election theft: "They are religious extremists." He names those who know about stolen elections, and he insists that the only way to protect this election is with paper ballots, hand-counted. |

(interview in segments--java)

Twenty-Six Things We Now Know Seven Years After 9/11

Twenty-Six Things We Now Know Seven Years After 9/11By Bernard Weiner

Co-Editor, The Crisis Papers

September 9, 2008

Treasury and the Fed Looking at Options

WASHINGTON — For the Federal Reserve and the Treasury Department, the crisis continues.

Without the broad bailout plan they invented and lobbied hard for, the two agencies are once again forced to careen from one desperate path to another, and to dig deep into their toolkits to rescue the global financial system. Even before the House stunned the world on Monday by rejecting the Bush administration’s bailout bill, the Fed was already resorting to the oldest action in its book: printing money.

With money markets around the world seizing in fear, the Fed on Monday announced that it would provide an extra $150 billion through an emergency lending program for banks, and an additional $330 billion through so-called swap lines with foreign central banks to help money markets from Europe to Asia.

It was an extraordinary display of financial power, and it reflected acute new anxiety at the Fed and central banks around the world that the crisis of confidence in American financial markets had metastasized to money markets everywhere.

That was on top of the $230 billion the Fed borrowed last week so it could finance its previous efforts to prop up the American International Group and other institutions. But these are only the latest in a long series of jaw-dropping departures from normal policy that the Fed has undertaken this year as it seeks to inject vast amounts of capital into the financial system. And they are unlikely to be the last.

Even if Congress refuses to pass the bailout measure, there is more money where that came from. The Treasury Department has already created a series of “supplemental” Treasury securities to finance the Fed’s activities, and there is no limit to how many more it can issue and sell.

Treasury and Fed officials made it clear after the House vote on Monday that they still had a wide range of tools at their disposal. But most of the remaining options are ad hoc, rather than systemwide. The Fed, for example, can lend money to any company it deems too dangerous to fail by invoking the same Depression-era law it has already used to deal with failing firms like Bear Stearns and A.I.G.

The Treasury Department, meanwhile, has already vowed to buy up billions of dollars in mortgage-backed securities under the authority it received in the housing bill that Congress passed in the summer.

The bad news is that those attempts have done little or nothing to bolster confidence in the financial markets. Yields on three-month Treasury bills shrank to just 0.29 percent on Monday, a sign that investors were fleeing from any kind of risk, even if it meant earning a return far lower than the inflation rate.

Interbank lending rates climbed to new highs on Monday, as banks became even more fearful about lending to one another than they were last week.

“The liquidity measures are a stopgap,” said Laurence H. Meyer, vice chairman of Macroeconomic Advisers, a forecasting firm. “You’re funding the banks’ balance sheets, but nobody wants to lend money to them because they’re all afraid of insolvency.”

Administration officials were shocked at the House’s refusal to approve their bailout plan but are still hoping to rescue the plan later this week, by offering some modifications that will win over rebellious House Republicans without losing crucial Democratic votes.

“We need to put something back together that works,” said Treasury Secretary Henry M. Paulson Jr. Though he promised to “use all the tools available to protect our financial system,” he warned that “our toolkit is substantial but insufficient.”

In the absence of broader authority, Treasury officials are reviewing the options for creatively using the same kinds of case-by-case actions they have taken over the last six months — taking over Fannie Mae and Freddie Mac, bailing out A.I.G., and arranging shotgun marriages between failing institutions and healthy ones.

Robert A. Dye, chief economist at PNC Financial in Pittsburgh, said those efforts amounted to patchwork solutions and had thus far failed to bolster confidence in credit markets.

“The problem is that these are just a series of ad hoc solutions on a business-by-business basis, and they aren’t addressing the systemic problems in any basic way,” Mr. Dye said.

But other analysts said that credit markets around the world were almost entirely dysfunctional on Monday morning, when political leaders and investors alike assumed that Congress had reached a firm deal and would easily approve the bailout.

“It’s our view that this package, in a fundamental sense, will not solve the problem,” said Simon Johnson, a former chief economist at the International Monetary Fund. Mr. Johnson said that he had been hoping that the bailout plan would simply stabilize the markets through the presidential elections in November, but that he was now pessimistic about even that.

Michael Darda, chief economist at MKM Partners, an investment firm in Greenwich, Conn., said the Treasury’s bailout plan might have even unnerved many investors.

“I don’t see how it can help banks unless it’s clear that the government is going to buy these assets for substantially more than they are worth right now,” Mr. Darda said. “It’s such a big step in terms of government influencing the private sector, and it’s hard for investors to take a leap like that overnight, especially when they don’t know what’s going on.”

The Federal Reserve has stretched its resources to the limit. Before the crisis began in August 2007, the Fed had about $800 billion in reserve, nearly all in Treasury securities.

But because of all the new lending programs for banks and Wall Street firms, analysts estimate that the Fed’s balance sheet now has less than $300 billion in unfettered reserves.

The central bank can expand its reserves at will, because it controls the money supply and can create more to buy things like Treasury securities and mortgage-backed securities.

“We have a lot of money to play with,” said Kenneth Rogoff, an international economist at Harvard. “As long as foreigners have a lot of confidence in our ability to solve our problems, we can borrow the $1 trillion to $2 trillion we need to solve it.”

But Mr. Rogoff cautioned that the real limitation for American policy makers is whether they can maintain the government’s long-term credibility. “The real constraint is not a bookkeeping one,” he said. “It is a sense of faith on the part of foreigners that the U.S. government will repay its debt. Our most precious asset is that credibility.”

As risk grows, resources strained at Fed, FDIC

By Peter G. Gosselin and James PuzzangheraLos Angeles Times Staff Writers

September 30, 2008

WASHINGTON — If the House vote against the $700-billion financial rescue proposal stands, Americans may be in for a test of free-market economics the likes of which the country hasn't seen since the early 1930s.

With the Treasury Department hobbled by the rejection of its plan, the Federal Reserve and Federal Deposit Insurance Corp. are the chief government institutions standing between the nation and the brutally Darwinian process that could unfold if the panicky financial markets are left to sort their problems out alone.

It's an open question whether those two institutions acting alone have the resources and power to avert such a debacle -- the cascading failure of hundreds, perhaps thousands, of financial institutions and paralysis spreading across the whole economy.

"We're entering a new phase of the crisis," said Chris Rupkey, chief financial economist with the Bank of Tokyo-Mitsubishi in New York. "If you don't stop the domino effect, you're going to see one institution after another after another going down," he predicted.

That's something the United States last experienced in the early 1930s, when Herbert Hoover was in the White House. Some conservatives believe that's still the best long-term solution to the problem, though none has gone so far as Hoover's Treasury secretary, Andrew Mellon, who said: "Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. . . . It will purge the rottenness out of the system."

But House members and their supporters who insisted Monday that the government had no business staging a massive intervention in the financial marketplace were essentially making a modern-day argument for the laissez-faire economic policies of the Mellon era.

For now, the Fed and FDIC are doing what they can.

Early Monday, the Fed pumped an extra $630 billion into banks around the world. Its goal: to keep money flowing through the financial plumbing that's hidden from view but is crucial to the global economy's operation.

Meanwhile, the FDIC, for the second time in a week, orchestrated the safe demise of a major bank, this time helping engineer the sale of Wachovia Corp., the nation's fourth-largest bank by assets, to Citigroup Inc.

The deal puts Washington on the hook if losses in Wachovia's $312-billion loan portfolio top $42 billion.

But the two government agencies are severely limited in what they can do to keep the crisis from affecting ordinary Americans.

For the Fed, the problem is that with business confidence so shaken, the banks on the receiving end of its latest flood of cash are parking the money in their vaults rather than lending it out to keep the economy functioning. Bankers worry that they might need the money if conditions keep getting worse.

"They won't even lend it to each other," said Brookings Institution economist Robert E. Litan, "and if they're not going to lend it to each other, they certainly aren't going to lend it to you and me."

The lending drought means that people are having a harder time borrowing to buy houses, cars and appliances, and business are having a harder time generating sales.

Little cash is available for growth and job creation. But there's a more immediate danger: To an extent little appreciated by most Americans, businesses today no longer pay for their day-to-day operations with their own money but do so with borrowed funds.

Making next week's payroll or buying the supplies workers need to do their jobs tomorrow depend on loans. Without those loans, companies and the economy as a whole begin to grind to a halt.

The slowdown is feeding other problems that plague the nation: plunging home prices, the imploding value of mortgage securities and collapsing confidence. Among other things, that's all but certain to push more financial firms over the edge.

When that happens, the Fed and the FDIC have only one course of action: to pick and choose among collapsing firms, deciding which ones get a soft landing and which ones crash.

And the ad-hoc rescue efforts create damaging ripples of their own.

"It's very difficult for the market to know how to react when each government intervention is different," complained Jaret Seiberg, a financial services analyst with Stanford Group. "There's no rhyme or reason, and that leads to more market instability."

There's another problem with leaving the solution to the financial crisis to the Fed and the FDIC: Though they have yet to reach it, each probably has a limit to its capacity to make rescues.

For the Fed, the constraint is not the central bank's ability to pump out cash, which is essentially limitless. Instead, it's the quantity of the risky securities of troubled financial firms it can take on its books -- as collateral for the loans it makes to the firms -- without weakening its own financial condition.

Since the beginning of the year, Fed records show that the proportion of outside securities on the central bank's books has climbed to about 60%, while the fraction of risk-free U.S. Treasury securities among its assets has dropped from 90% to 40%.

Fed officials assert that the change doesn't limit the central bank's ability to act, but outside analysts such as Brookings economist Litan are not so sure. "The Fed is looking more and more like any other private financial institution," he said.

In the case of the FDIC, the limit is the size of the fund that insures bank deposits. The fund had $45.2 billion as of June 30, raised from premiums paid by banks. The FDIC plans to increase those premiums, although it's unclear that the rise will be substantial, given the current crisis. In addition, it can borrow up to $30 billion from the Treasury.

If Washington's rescue resources were to run out, the nation's investors, traders and lenders could discover that it was up to them alone to right the financial system.

That's a situation that has not occurred in more than three-quarters of a century, during the Great Depression.

"This is smacking more and more of the late 1920s and early 1930s," said New York University economic historian Richard Sylla.

In fact, in a less disastrous manner than during the Depression, something like Mellon's prescription of across-the-board liquidation is now underway.

And without a big, new program like the one rejected by the House on Monday, there is only so much the existing institutions can do.

The FDIC's scope is limited. And, Rupkey said, "the Fed's balance sheet is about to explode."

peter.gosselin@latimes.com

Bloomberg News

LONDON: The cost of borrowing in dollars surged the most on record Tuesday after the U.S. Congress rejected a $700 billion bank rescue plan, heightening concern more institutions will fail.

The London interbank offered rate, or Libor, that banks charge each other for such loans climbed 431 basis points to an all-time high of 6.88 percent Tuesday, the British Bankers' Association said. The euro interbank offered rate, or Euribor, for one-month loans climbed to record 5.05 percent, the European Banking Federation said. The Libor-OIS spread, a gauge of the scarcity of cash, advanced to a record. Rates in Asia also rose.

"The money markets have completely broken down, with no trading taking place at all," said Christoph Rieger, a fixed- income strategist at Dresdner Kleinwort in Frankfurt. "There is no market any more. Central banks are the only providers of cash to the market, no-one else is lending."

Credit markets have seized up, tipping banks toward insolvency and forcing U.S. and European governments to rescue five banks in the past two days, including Dexia, the world's biggest lender to local governments, and Wachovia. Money-market rates climbed even after the Federal Reserve Monday more than doubled the size of its dollar-swap line with foreign central banks to $620 billion. Banks borrowed dollars from the ECB at almost six times the Fed's benchmark interest rate Tuesday.

The two-month Libor rose to 5.13 percent Tuesday, also a record. Libor, set by 16 banks including Citigroup and UBS in a daily survey by the BBA, is used to calculate rates on $360 trillion of financial products worldwide, from home loans to credit derivatives.

Funding constraints are being exacerbated as companies try to settle trades and buttress balance sheets over the quarter-end, balking at lending for more than a day.

"Counterparty fear in the banking sector is at a new extreme," said Greg Gibbs, director of currency strategy at ABN Amro Holding Bank in Sydney. "Credit conditions are as tight as a drum. Unless this settles down, central banks would need to cut rates globally to bring funding costs down."

The ECB said it lent banks $30 billion for one day at a marginal rate of 11 percent. The Fed's key rate is 2 percent. The ECB said it received bids for $77.3 billion. The Bank of Japan injected more than ¥19 trillion, or $182 billion, into the country's system over the past two weeks, the most in at least six years. The Reserve Bank of Australia pumped in A$1.95 billion, or $1.6 billion, Tuesday.

Click here to view the video explaining LIBOR: http://www.learningmarkets.com/index...sis&Itemid=380

Why are Economists Worrying About a Rising LIBOR?

In the midst of the largest financial crisis since The Great Depression, you are probably hearing a lot about LIBOR rising—which is a sign that the global credit markets are seizing up because banks are afraid to loan to each other because they don't know if the other banks they are loaning to are going to exist next week, let along be able to pay back those loans. But what on earth is LIBOR? (Video Below) LIBOR - London Interbank Offered Rate

London Interbank Offered Rate (LIBOR)

The financial markets are full of acronyms, and one of my favorites is LIBOR. The acronym LIBOR stands for London InterBank Offered Rate. This is the average interest rate that banks charge when they make short-term unsecured loans to other banks.

Unlike the Federal Funds Rate or the Discount Rate, which are both set by the U.S. Federal Reserve, nobody "sets" the LIBOR rate. Instead, the British Bankers' Association (BBA) surveys 16 different major banks and asks them what rate they are charging other banks to borrow money. Once they have compiled the results, they take an approach similar to the judges who score Olympic diving take—they throw out the four high scores (or rates) and throw out the four low scores and then find the average of the remaining eight scores. Here's how it works:

Imagine the BBA goes out, surveys its 16 banks and ends up with the following interest rates being charged by each bank:

- Bank #1 — 3.87%

- Bank #2 — 3.85%

- Bank #3 — 3.81%

- Bank #4 — 3.76%

- Bank #5 — 3.75%

- Bank #6 — 3.74%

- Bank #7 — 3.71%

- Bank #8 — 3.69%

- Bank #9 — 3.67%

- Bank #10 — 3.66%

- Bank #11 — 3.63%

- Bank #12 — 3.62%

- Bank #13 — 3.60%

- Bank #14 — 3.57%

- Bank #15 — 3.53%

- Bank #16 — 3.48%

In this case, the BBA would throw out the top four rates (Banks 1–4) and the bottom four rates (Banks 13–16) and then average the rates from the remaining banks (Banks 5–12) to come up with a LIBOR rate of 3.68 percent.

The BBA conducts these surveys and then calculates the LIBOR rate once a day at about 11 am London time.

What Does LIBOR Tell Us?

When LIBOR is rising, it tells us one of two things: 1) it tells us that interest rates in general are rising and thus LIBOR is also rising, and/or 2) it tells us that lending banks believe the banks they are lending to have a higher risk of defaulting on the loan so the lending bank has to charge a higher interest rate to offset this risk.

When LIBOR is falling, it tells us one of two things: 1) it tells us that interest rates in general are falling and thus LIBOR is also falling, and/or 2) it tells us that lending banks believe the banks they are lending to have a lower risk of defaulting on the loan so the lending bank does not have to charge a higher interest rate to offset this risk.

You can also compare LIBOR to other indicators to conduct spread analyses, like the LIBOR OIS Spread (more on this later).

What's Responsible for the TED Spread's Recent Behavior?

One measure that is being used to summarize the strain in financial markets is the TED spread. This is calculated as the gap between 3-month LIBOR (an average of interest rates offered in the London interbank market for 3-month dollar-denominated loans) and the 3-month Treasury bill rate. The size of this gap presumably reflects some sort of risk or liquidity premium. I was interested to break the TED spread down into identifiable components to try to get a better understanding of what may be responsible for its recent behavior.

The TED spread over the last 5 years is plotted below; for a longer time series see Bespoke Investment Group. Historically the spread typically stayed under 50 basis points. However, it's usually been above 100 basis points since the credit events of August 2007, and reached 300 several times during the last two weeks.

|

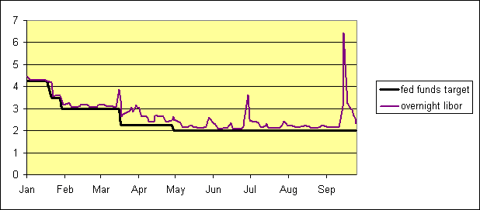

The overnight interest rate on loans between banks in the U.S. money market is the fed funds rate, whose average value is set as the primary target of U.S. monetary policy. There is also an overnight LIBOR rate, whose borrowers and lenders include some of the same banks that participate in the U.S. federal funds market, albeit a little earlier in the day. As a first step to understanding the LIBOR-TBILL spread, I was curious to look at the difference between the overnight LIBOR rate and the fed funds target. This had a rather impressive spike September 16-17.

|

Why would a bank want to borrow overnight dollars for 5-6% in London when it could be assured of obtaining those same funds for 2% later that day in New York? For one thing, the situation was sufficiently chaotic two weeks ago that many banks in fact were unable to borrow in New York at 2%. The effective fed funds rate (a volume-weighted average of all the known U.S. trades on a given day) was 2.64% on Sept 15 and 2.80% on Sept 17, despite the Fed's intention to keep these numbers around 2.0. Somebody who was worried about how these days were going to unfold may have quite rationally bid quite a bit to secure the funds early. Or perhaps the U.S. banks dropped out of the London market altogether. In any case, a one- or two-day spike in this overnight rate is not that big a deal, since even a few hundred basis points (at an annual rate) is not that much money on a one-day loan. Following that impressive but brief spike, overnight LIBOR is now back to 2.31%, a modest 31 basis points over the Fed's target.

One can break the TED spread down into separate components using the following accounting identity. Let LIBOR3 denote the 3-month LIBOR rate, LIBOR0 the overnight rate, TARGET the fed funds target, and TBILL the 3-month Treasury bill rate. The TED spread is defined as

TED = (LIBOR3 - TBILL)

which can be rewritten as

(LIBOR3 - TBILL) = (LIBOR3 - LIBOR0) + (LIBOR0 - TARGET) + (TARGET - TBILL)

As just discussed, the middle term above, LIBOR0 - TARGET, is at the time of this writing back to usual values, so the bloated value for the TED spread must be coming from a combination of the first and last terms. Indeed on Friday, the spread between the 3-month and overnight LIBOR rate stood at 145 basis points:

(LIBOR3 - LIBOR0) = 1.45

Why is the 3-month rate so much higher than the overnight rate? It certainly can't be an expectation that the Fed's target for the overnight fed funds rate is about to increase. If the Fed makes a move over the next 3 months (and it very well could), it would be for a decrease, not an increase, in the target. The LIBOR term spread must therefore be interpreted as some sort of a liquidity or risk premium. If I lend you funds overnight, I should have a pretty good idea of whether there's some news coming within the next 24 hours that would prevent you from repaying. I may correctly judge that risk to be small. But over the next 3 months, who knows what might happen? If I were a risk-neutral lender, and I thought there was a 0.36% chance that a currently sound bank may go completely bankrupt over the next 90 days, I'd want a 145-basis point (annual rate) premium on the 3-month loan as compensation. If I were risk averse, I would require that 145-basis-point compensation even with a much lower probability of default.

Or, it may be that I'm afraid I myself might be exposed to some severe credit event over the next 3 months, and would be better off keeping any extra cash in Treasuries rather than lending them 3 months unsecured. I would describe this consideration as a "liquidity premium" as opposed to a "risk premium".

If leading financial institutions are making these sorts of assessments of the probabilities of risk or liquidity needs, it bespeaks a very unsettled financial market that is apt to function poorly at channeling funds to any of the other inherently risky economic investments whose funding is vital for a functioning economy.

But this risk/liquidity premium only accounts for half of the TED spread. The remainder is due to the gap between the fed funds target (currently 2.0%) and the yield on 3-month Treasuries (now under 1%). This is the other part of the "flight to quality" just discussed. But on the other hand, the (TARGET - TBILL) gap is also a deliberate choice of policy. The Fed could simply lower its target for the fed funds rate, and chase the T-bill rate down to zero, if it wanted.

What's the downside to that? Here's the next shoe that could drop: the financial dislocations could lead to a perception by global investors that the U.S. is no longer a safe place to be putting their capital, which could add a currency crisis component to the present financial turmoil. Greg Mankiw notes this report:

China's government moved to calm financial markets Thursday and denied a report that it had ordered mainland banks to curb lending to U.S. banks, a day after rumors of financial stability led to a run on a Hong Kong institution.

Calm again for the time being, I guess. But if a cut in the fed funds rate leads to rapid dollar depreciation and commodity inflation, it could be pulling the trigger on something even scarier than what we've seen so far.

Not an attractive set of options on the menu for the FOMC.

Monday, September 29, 2008

FINAL VOTE RESULTS FOR ROLL CALL 674

H R 3997 RECORDED VOTE 29-Sep-2008 2:07 PM

QUESTION: On Concurring in Senate Amendment With An Amendment

BILL TITLE: To amend the Internal Revenue Code of 1986 to provide earnings assistance and tax relief to members of the uniformed services, volunteer firefighters, and Peace Corps volunteers, and for other purposes

| Ayes | Noes | PRES | NV | |

| Democratic | 140 | 95 | ||

| Republican | 65 | 133 | 1 | |

| Independent | ||||

| TOTALS | 205 | 228 | | 1 |

| Ackerman Allen Andrews Arcuri Bachus Baird Baldwin Bean Berman Berry Bishop (GA) Bishop (NY) Blunt Boehner Bonner Bono Mack Boozman Boren Boswell Boucher Boyd (FL) Brady (PA) Brady (TX) Brown (SC) Brown, Corrine Calvert Camp (MI) Campbell (CA) Cannon Cantor Capps Capuano Cardoza Carnahan Castle Clarke Clyburn Cohen Cole (OK) Cooper Costa Cramer Crenshaw Crowley Cubin Davis (AL) Davis (CA) Davis (IL) Davis, Tom DeGette DeLauro Dicks Dingell Donnelly Doyle Dreier Edwards (TX) Ehlers Ellison Ellsworth Emanuel Emerson Engel Eshoo Etheridge Everett Farr Fattah Ferguson | Fossella Foster Frank (MA) Gilchrest Gonzalez Gordon Granger Gutierrez Hall (NY) Hare Harman Hastings (FL) Herger Higgins Hinojosa Hobson Holt Honda Hooley Hoyer Inglis (SC) Israel Johnson, E. B. Kanjorski Kennedy Kildee Kind King (NY) Kirk Klein (FL) Kline (MN) LaHood Langevin Larsen (WA) Larson (CT) Levin Lewis (CA) Lewis (KY) Loebsack Lofgren, Zoe Lowey Lungren, Daniel E. Mahoney (FL) Maloney (NY) Markey Marshall Matsui McCarthy (NY) McCollum (MN) McCrery McDermott McGovern McHugh McKeon McNerney McNulty Meek (FL) Meeks (NY) Melancon Miller (NC) Miller, Gary Miller, George Mollohan Moore (KS) Moore (WI) Moran (VA) Murphy (CT) Murphy, Patrick Murtha | Nadler Neal (MA) Oberstar Obey Olver Pallone Pelosi Perlmutter Peterson (PA) Pickering Pomeroy Porter Price (NC) Pryce (OH) Putnam Radanovich Rahall Rangel Regula Reyes Reynolds Richardson Rogers (AL) Rogers (KY) Ross Ruppersberger Ryan (OH) Ryan (WI) Sarbanes Saxton Schakowsky Schwartz Sessions Sestak Shays Simpson Sires Skelton Slaughter Smith (TX) Smith (WA) Snyder Souder Space Speier Spratt Tancredo Tanner Tauscher Towns Tsongas Upton Van Hollen Velázquez Walden (OR) Walsh (NY) Wasserman Schultz Waters Watt Waxman Weiner Weldon (FL) Wexler Wilson (NM) Wilson (OH) Wilson (SC) Wolf |

| Abercrombie Aderholt Akin Alexander Altmire Baca Bachmann Barrett (SC) Barrow Bartlett (MD) Barton (TX) Becerra Berkley Biggert Bilbray Bilirakis Bishop (UT) Blackburn Blumenauer Boustany Boyda (KS) Braley (IA) Broun (GA) Brown-Waite, Ginny Buchanan Burgess Burton (IN) Butterfield Buyer Capito Carney Carson Carter Castor Cazayoux Chabot Chandler Childers Clay Cleaver Coble Conaway Conyers Costello Courtney Cuellar Culberson Cummings Davis (KY) Davis, David Davis, Lincoln Deal (GA) DeFazio Delahunt Dent Diaz-Balart, L. Diaz-Balart, M. Doggett Doolittle Drake Duncan Edwards (MD) English (PA) Fallin Feeney Filner Flake Forbes Fortenberry Foxx Franks (AZ) Frelinghuysen Gallegly Garrett (NJ) Gerlach Giffords | Gillibrand Gingrey Gohmert Goode Goodlatte Graves Green, Al Green, Gene Grijalva Hall (TX) Hastings (WA) Hayes Heller Hensarling Herseth Sandlin Hill Hinchey Hirono Hodes Hoekstra Holden Hulshof Hunter Inslee Issa Jackson (IL) Jackson-Lee (TX) Jefferson Johnson (GA) Johnson (IL) Johnson, Sam Jones (NC) Jordan Kagen Kaptur Keller Kilpatrick King (IA) Kingston Knollenberg Kucinich Kuhl (NY) Lamborn Lampson Latham LaTourette Latta Lee Lewis (GA) Linder Lipinski LoBiondo Lucas Lynch Mack Manzullo Marchant Matheson McCarthy (CA) McCaul (TX) McCotter McHenry McIntyre McMorris Rodgers Mica Michaud Miller (FL) Miller (MI) Mitchell Moran (KS) Murphy, Tim Musgrave Myrick Napolitano Neugebauer Nunes | Ortiz Pascrell Pastor Paul Payne Pearce Pence Peterson (MN) Petri Pitts Platts Poe Price (GA) Ramstad Rehberg Reichert Renzi Rodriguez Rogers (MI) Rohrabacher Ros-Lehtinen Roskam Rothman Roybal-Allard Royce Rush Salazar Sali Sánchez, Linda T. Sanchez, Loretta Scalise Schiff Schmidt Scott (GA) Scott (VA) Sensenbrenner Serrano Shadegg Shea-Porter Sherman Shimkus Shuler Shuster Smith (NE) Smith (NJ) Solis Stark Stearns Stupak Sullivan Sutton Taylor Terry Thompson (CA) Thompson (MS) Thornberry Tiahrt Tiberi Tierney Turner Udall (CO) Udall (NM) Visclosky Walberg Walz (MN) Wamp Watson Welch (VT) Westmoreland Whitfield (KY) Wittman (VA) Woolsey Wu Yarmuth Young (AK) Young (FL) |

| Weller |

House bailout efforts minute by minute

11:48 AM PDT, September 29, 2008

11:33 A.M.: House Minority Whip Roy Blunt, the Republicans' top vote-counter in the House, tells a news conference that he miscounted -- he believed Republicans had a dozen more votes for the bailout than they really did. He blames "partisan discussion" for the failure of the bill.

11:13 A.M.: The Los Angeles Times reports the bailout has failed in the House.

11:08 A.M.: CNN, reading wire copy live on air, reports the bill has been defeated in the House. Some confusion evident on the House floor. The Dow industrials fall 616 points. CNN had earlier pointed out that a Dow sell-off of this magnitude "is not a crash."

Why the Bailout Bill Failed

So how could a major bill described by the president and both parties' leaders as critical to the well-being of the nation's -- and the world's -- economy go down to defeat?

There are no easy answers here, as the House's stunning defeat moments ago of the financial bailout legislation is putting us into seemingly uncharted territory. But while the final tally, with 133 Republicans and 95 Democrats voting no, was a surprise -- all morning, Hill sources were predicting narrow passage -- the signs were there that the measure was in trouble:

1) Poor Salesmanship. Did you know that the general consensus is now that this bill will not cost $700 billion? If you didn't, it's because the bill's proponents did a poor marketing job. From the start, the Bush administration did not do enough to emphasize the point that taxpayers would get at least some of the money back, and that gigantic price tag got stuck in the head of the public (and the media).