Follow the money

Round and round

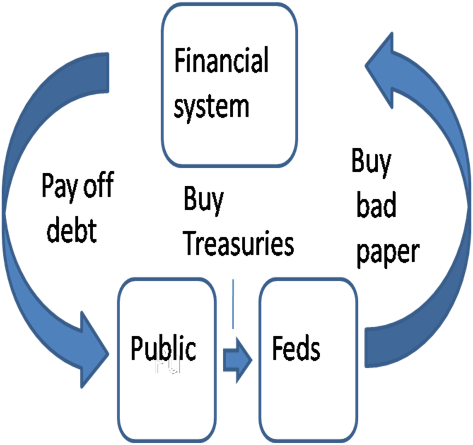

Round and roundWhere will the money for the big bailout come from? I keep being asked that. In the long run, of course, it will come from you — the taxpayer. But what about the immediate cash flow?

The answer, if you think it through, is that it doesn’t have to come from anywhere. Ultimately, the Paulson Plan will move money in a circle.

Think about what’s been happening in the markets. The public basically wants out of the private financial system and into Treasuries. But the financial system has been unable to meet that demand, because it can’t sell off toxic paper. Now, under the Paulson plan, the Treasury will buy the toxic paper, which will give the financial sector the funds to pay off debtors, who will use the funds to buy the Treasuries the feds will have to issue to finance the toxic-paper purchases.

Uneasy feelings

Details are scarce on the big buyout; but as a few dribble out, I’m getting uneasy.

Here’s the source of my uneasiness: the underlying premise behind the buyout seems, still, to be that this is mainly a liquidity problem. So if the government stands ready to buy securities at “fair value”, all will be well.

But it’s by no means clear that this is right. On one side, the government could all too easily end up paying more than the securities are worth — and if there isn’t some kind of mechanism for capturing windfalls, this could turn into a bailout of the stockholders at taxpayer expense.

On the other side, what if large parts of the financial sector are still underwater even if the assets are sold at “fair value”? Is there a provision for recapitalizing firms so they can keep on functioning?

Maybe the plan will look fine once we see the details. But while Paulson and Bernanke are a lot better than the people we might have had in there (thank you, Harriet Meiers!), their track record to date does not lead to the automatic conclusion that they know what they’re doing.

McCain on banking and health

OK, a correspondent directs me to John McCain’s article, Better Health Care at Lower Cost for Every American, in the Sept./Oct. issue of Contingencies, the magazine of the American Academy of Actuaries. You might want to be seated before reading this.

Here’s what McCain has to say about the wonders of market-based health reform:

Opening up the health insurance market to more vigorous nationwide competition, as we have done over the last decade in banking, would provide more choices of innovative products less burdened by the worst excesses of state-based regulation.

So McCain, who now poses as the scourge of Wall Street, was praising financial deregulation like 10 seconds ago — and promising that if we marketize health care, it will perform as well as the financial industry!

No comments:

Post a Comment