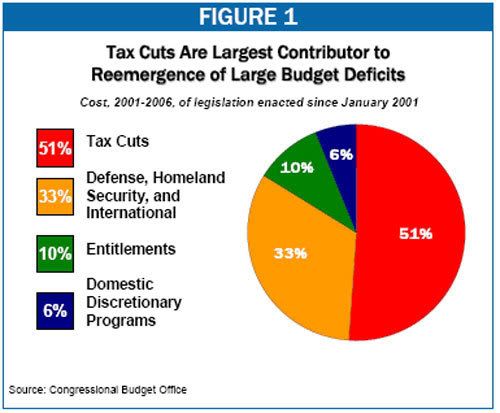

Nup, don't think it's spending that is ballooning the budget Mr. McCain...--java

Nup, don't think it's spending that is ballooning the budget Mr. McCain...--java

From left, Defense Secretary Robert M. Gates, Chairman of the Joint Chiefs of Staff Adm. Michael G. Mullen, Gen. David H. Petraeus and Gen. Ray Odierno at a ceremony in Baghdad on Tuesday marking the handover of the United States military command.

Odierno Succeeds Petraeus as Iraq Commander

CAMP VICTORY, Iraq — In an ornate palace built by the deposed dictator Saddam Hussein, the United States military command of the war in Iraq changed hands Tuesday from Gen. David H. Petraeus, who created the surge strategy, to Gen. Ray Odierno, who oversaw its day-to-day operations across a country that has witnessed a significant drop in violence.

Attending the hour-long hand-over ceremony were Defense Secretary Robert M. Gates; Adm. Mike Mullen, chairman of the Joint Chiefs of Staff; Gen. Martin Dempsey, acting Central Command commander; and senior Iraqi government and military officials. Mr. Gates later traveled on to Kabul, Afghanistan.

In his first, brief comments as commander of the multinational forces in Iraq, General Odierno said, “We must realize that these gains are fragile and reversible, and our work here is far from done.”

Formerly the No. 2 commander, he faces the challenge of improving on the hard-earned security gains in Iraq with fewer troops, as the United States begins preparations to withdraw 8,000 troops by early next year. The overall American military presence in Iraq, which includes 15 combat brigades as well as support and logistics personnel, would then number about 138,000.

General Petraeus takes over as commander of the American military’s Central Command, responsible for military issues across the strategically important crescent that stretches from Pakistan, across Central Asia and the Middle East, and throughout the Persian Gulf, and includes both operations in Iraq and, most notably, a troubled mission in Afghanistan. The ornate Faw Palace, where the ceremony took place was built as Mr. Hussein’s suburban Baghdad retreat; it is now headquarters at a base named by the American military as Camp Victory in a moment of early post-war optimism.

In his comments at the ceremony, Mr. Gates cautioned that “our enemies are down but not out” in Iraq and he said that General Odierno was taking command at “a pivotal moment.” It is his third tour of duty here.

Afterward, General Odierno, in his first public remarks upon taking command, said he looked forward to the focus in Iraq evolving from a military to a civilian-led effort.

He said that over the next year and beyond, what he hoped to see was “an adjustment from a military lead to a political, diplomatic, economic-led strategy.”

“And that,” he said, “would coincide with a reduction of U.S. presence, coalition presence here, and Iraqi security forces taking on more of the presence.”

He said that he hoped to maintain the hard-won security improvements and take Iraq from a “fragile” to a “stable” state, but that he would focus until the end of the year on assessments and consulting with the Iraqi government before making “some recommendations” about the future.

He stressed the importance of the Iraqi government supplementing the security gains with political and legislative progress, singling out the importance of provincial elections and “a continued improvement in the capacity of the government of Iraq to deliver services to the people.”

Asked how his outlook differed from General Petraeus, who embraced him during the handover ceremony, he said: “Of course every commander is different, nobody is exactly the same. But I think philosophically we are fairly close.”

But, he added: “I think the time is changing a little bit. Iraq is becoming a more sovereign nation. Iraq is going to take on more of the responsibility and it is my job to make sure that we are able to do that in a very smooth way where we don’t fall back.”

Remember the old Steve Martin routine on how to make a million dollars and not pay taxes: "First, make a million dollars... Second, don't pay taxes." Turns out Martin's joke is standard operating procedure for corporations in the United States -- only, in comparison, Martin was a piker.

(BTW, Congressional Budget Office estimates that Corporate Taxes make up only 2.2% of federal tax revenue. Yep, you and your kids are on the hook, not the golden parachuted CEO or CFO of those ever so clever multinational corporations. Feeling the ground shift, just slightly?--java)

Today, the Government Accountability Office (GAO) released a study on taxes paid by corporations. In what Sen. Byron L. Dorgan (D-ND) mildly called "a shocking indictment of the current tax system," the GAO found that about two-thirds of corporations operating in the US did not pay taxes annually from 1998 to 2005.

Now most corporations in America are start-ups or small, mom and pop operations that have adopted a corporate form to lower their tax rates. And a greater percentage of large corporations do pay some taxes. But in 2005, with corporate profits reaching new heights as a percentage of national income, the GAO found that over one-fourth -- 28% of large corporations paid no taxes. (It defined large corporations as those with assets of at least $250 million dollars or gross receipts of at least $50 million dollars.) They can tell you how to make $50 million dollars and not pay taxes.

Not surprisingly, the income collected from corporations has been declining as a percentage of GDP, with the burden transferred to your income and payroll taxes. According to a study by the Treasury Department, from 2000-2006, an average of 2.2% of GDP was collected in corporate taxes. This compares to an average of 3.4% in other industrial countries. The nonpartisan Congressional Budget Office projects that, under current law, corporate revenues will decline to 1.9% of GDP by 2017.

Why is this important? Well, the Bush administration, led by Treasury Secretary Paulson and conservatives led by John McCain are mounting a major campaign to cut the corporate tax rate even more, arguing that we are crippled competitively by having a US rate higher than any industrial nation other than Japan. "America has the second highest business [tax]rate in the entire world," says John McCain. "Is it any wonder that jobs are moving overseas? We're taxing them out of the country." But the GAO study confirms what we already knew: whatever the nominal tax rate, US corporations pay an effective rate among the lowest in the industrial world.

Yet the core of McCain economic agenda consists of breath-taking corporate tax breaks. He calls for cutting the top corporate rate from 35% to 25% and allowing corporations to write off investments in the first year. Combined, the Tax Policy Center wonks cost these at over $1.3 trillion over 10 years. Len Burman of Tax Policy Center estimates that in total, McCain would cut corporate revenues by about 50% from current levels. They'll be making hundreds of millions of dollars and not paying taxes. This is no joke.

To pay for these tax breaks, sustain the Bush tax cuts, add more tax breaks AND balance the budget in four years, as McCain promises, will require heroic cuts in spending. Not military spending; McCain promises to increase that. How will he do this? On the stump, McCain promises to veto any earmarked spending. But that is a gesture, providing about $18 billion a year. (And he isn't exactly consistent. McCain often tells folks who defend a local project that it is the process, not the individual project that he opposes.) Perhaps that's why McCain calls for raising Medicare taxes on seniors with over $50,000 a year in income and taxing employer-based health care benefits for families. Working people and seniors will help pay the tab for the corporate tax give-away.

It's hard not to wonder about the pure, contrary, inanity of the current conservative position. Our military is by far the strongest in the world, while our trains are among the slowest and our sewers are collapsing. So they propose raising spending the military and cutting domestic investment. We suffer gilded age inequality, with the wealthiest 15,000 families -- one-one hundredth of one percent of the population -- capturing fully one-fourth of the entire income growth from 2000 to 2006. Their average income rose from $15.2 million per year to $29.7 million per year. Meanwhile, the rest of us -- 133 million households that make up 90% of the country -- divided up 4% of the nation's income, adding about $305 to our average $30,354 income. So conservatives push for more tax cuts for the wealthy, while proposing to tax employer based health benefits. Corporate profits (prior to the recession) have catapulted to what is by far the highest percentage of national income in the past half century. So they want to cut corporate taxes, inevitably increasing the burden on labor. The economic future looks dim because consumers, drowning in debt, are cutting back. So they suggest cutting taxes on corporate investments will generate new investments and growth -- as if companies don't need someone to buy the products they make.

Maybe that will be Steve Martin's next routine: How to sell more stuff and not have customers. Somehow, it doesn't sound so funny.

No comments:

Post a Comment